EU demands all big companies and banks ensure their entire value chain comply with ESRS.

Calculating Scope 3 CO2-emissions (in ESRS module E1) manually is usually costly and time demanding.

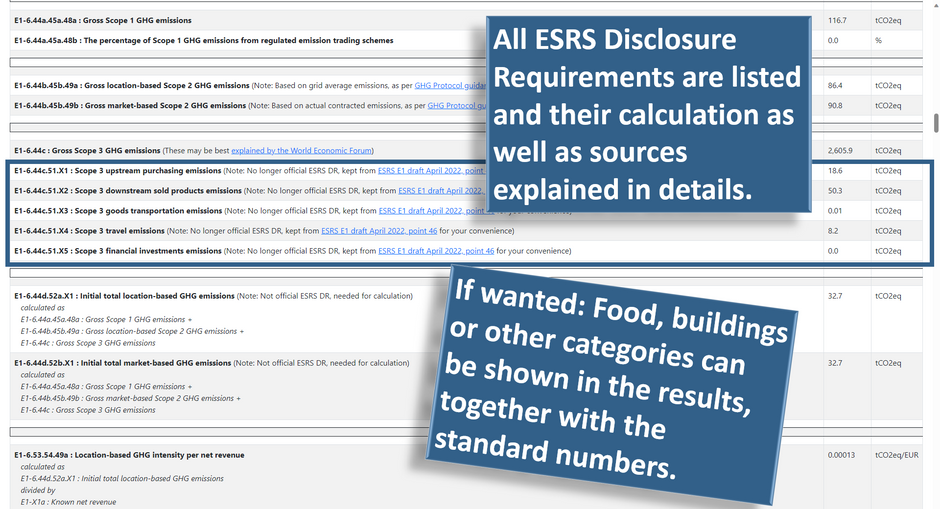

But lots of details (more than you can see) about your dealings are in financial data, and our methods for calculating ESRS based on your transaction activity can automatically provide most of the ESRS E1 data needed for compliance.

Bookkeeping/ERP systems provide us secure access to analyze your activities, so we have quickly built a tool to give you ESRS E1 compliant data automatically with just a few clicks and a bit of waiting while our Microsoft Azure™ servers crunch the numbers.

If we are not yet integrated with you current bookkeeping/ERP system, you can alternatively just export and upload your bookkeeping files and accounting documents (contact us, often an API is available that we can collect from).

The Flow

Over the past two decades, Genetix Computing has worked within the area of complex data automation and compliance. This experience has culminated in the creation of Automated ESRS, a revolutionary solution designed to streamline the process of collecting and calculating ESRS data automatically for companies and their value chain partners.

With just a few clicks, businesses can leverage this solution. The data and calculations are rooted in the financial transactions of the company and the results are accessible only to the automated system and the company itself; no data is shared with third parties and not even with Automated ESRS staff unless the company in question gives consent in each case.

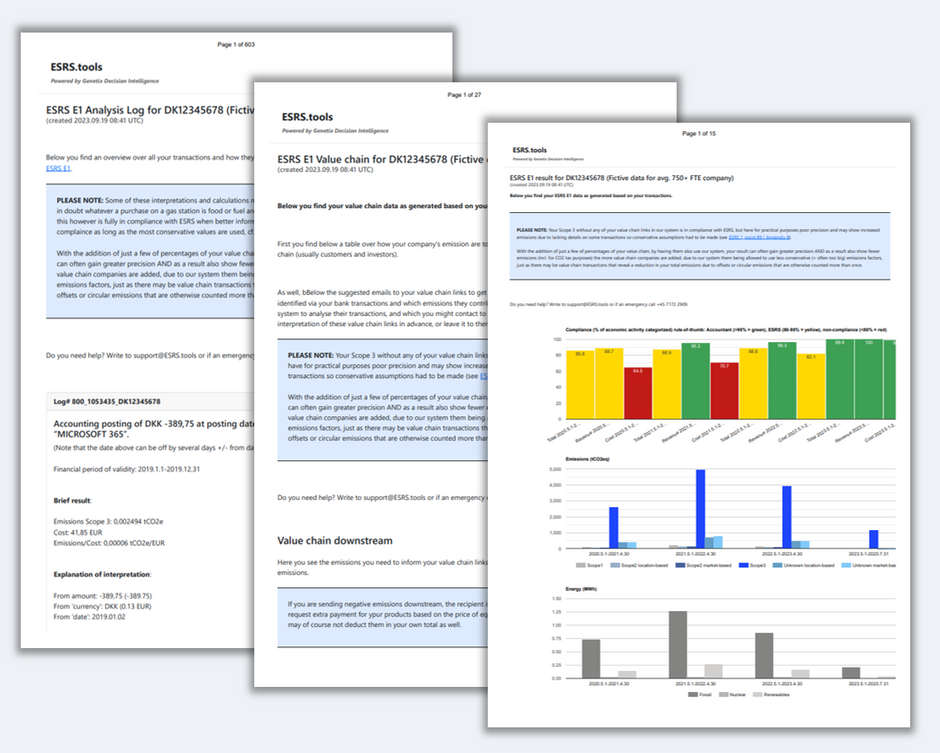

Our approach is determined by the available data, cross-referenced with ESRS rules. The entire process is meticulously documented in an analysis log, including all calculations, data sources and potential inaccuracies for each transaction, making it audit-ready.

Automated ESRS employs a hybrid approach that draws from various calculation methods, with a primary emphasis on activity-based calculations. This methodology combines spend-based, average data and supplier-specific methods to ensure the specificity and accuracy required for ESRS compliance. We are committed to delivering precise and forward-thinking ESRS E1 calculations while advancing ESRS data transparency.

Automated ESRS offers high-quality ESRS data (primary data) without the need for manual data entry. Automated ESRS has been developed based on the recommendations from EFRAG for CSRD/ESRS.

In summary, our solution delivers significant administrative efficiencies for companies, their supply chains, customers, and auditors while substantially mitigating the risk of greenwashing.

Automated ESRS has a data engine that collects data, interprets them based on smart algorithms and look-ups in GHG data and on the internet, and makes all calculations automatically, so you don't have to input any data nor do the calculations manually.

By letting Automated ESRS do the work for you quickly and securely, you can spend your time translating data into business decisions that immediately create business value.

The calculator uses these steps:

For an Automated ESRS E1 process based on accounting material, you must provide relevant accounting periods and accounts.

Data can be delivered in your preferred format and folder structure, via email or secure Microsoft Azure drive including account statements with dates, amounts, and transaction text. Attachments (invoices, receipts, and payment summaries, including scans and photos with handwriting, are accepted). Our system matches entries and attachments.

The data should also include a transaction overview and references (like document numbers) to associated documents. Attachments should correspond with references, possibly using an attachment number or filename.

The transaction data contains a comprehensive set of details which is the foundation of the activity-based calculations. Automated ESRS calculate ESRS data in a "locked data room“. The company's transactions and advice are encrypted and locked away and cannot be seen by Automated ESRS’ employees.

The data is stored on the servers for calculation purposes and will be deleted upon the customer's request. When support is requested, our employees can only see scrambled data: Full view of the transactions can only be accessed by the company itself.

With Genetix Automated ESRS software, financial data can be combined to automatically sort into sustainability metrics. Energy or carbon-related transactions can be categorized into ESRS metrics. This automation saves time and reduces reporting errors.

Automated ESRS ensures high data quality by using data sources and calculation methods that meet EU legal requirements (ESRS):

ESRS data are calculated using the company's bank transactions (activity based), which - unlike data entered by yourself - cannot be entered incorrectly or manipulated. This largely eliminates the risk of greenwashing.

Automated ESRS also makes it easy for auditors to check the calculations afterwards. Automated ESRS saves a log describing the calculation with precise reference to recognizable transaction data visible on your bank statement. The auditor can therefore check the statement using the log and access to the company's bank transaction data.

Besides the company’s transactions, ESRS.tools uses data a long list of sources approved for use with ESRS, ranging from the EU recommend GHG factors for each year (here linked for 2022) to publicly available fuel prices, local power plant and airplane emissions, goods transport emission databases, etc., all recommended under the GHG Protocol.

All sources are listed in the Analysis Log for each transaction and calculation where they are used, making the Automated ESRS result fully auditable for the company (due to the encryption key tied to the company, nobody else can access the analysis data).

By letting Automated ESRS collect and calculate your ESRS data quickly and securely, you can spend your time translating data into business decisions that immediately create business value.

With Automated ESRS you ensure that:

Automated ESRS' calculator follows the legal requirements set out by EFRAG (CSRD/ESRS). It is continuously updated with new legal requirements.

Automated ESRS helps you ensure that the statement is complete (all data is taken from bank accounts and no transactions are forgotten) and correct.

Automated ESRS is built on a technology that can recognize the content of bank transactions and translate them into CO2 and energy consumption. The precision of Automated ESRS calculation meets the EU's (ESRS) requirements for data quality.

Automated ESRS automatically calculates data with 5 years of history (provided that 5 years of transactions are available from your transaction data).

Automated ESRS can handle all types of CO2 scope 1, 2 and 3 emissions as well as related energy and revenue.

If there is an area where the calculator does not have sufficient information to be able to categorize the transaction correctly, a conservative assumption or average calculation will be made, so that the CO2 calculation is cautious, as well as still in compliance with ESRS even if not precise.

If in doubt, Automated ESRS will use the most emitting scenario and note in the Analysis Log that it is unsure.

The following apply, for example:

Only the holder of the company´s encryption key can see the company's data in Automated ESRS.

Automated ESRS is a locked solution where confidential data is machine reviewed after the company's approval. Therefore, no people outside the company can gain insight into the data. Nor can the Automated ESRS support staff.

Collected transaction/bookkeeping data is deleted as soon as the calculations are done.

Afterwards, only the calculated ESRS data and a log of the analysis are saved. This makes it possible for an auditor to revise the calculation afterwards if he or she has access to the company's bank transactions at the same time.

For troubleshooting and support on Automated ESRS, scrambled data is used, which does only reveal 3 ciphers of numbers and the first letter of words, allowing the user to refer to them and ask questions but supporters will need a screenshot or similar sent by email from the company user to be able to understand the data.

Automated ESRS can calculate Scope 3 (CO2 from/for the supply chain and customers) using either current data from the suppliers’ financial transactions or theoretical estimates, as dictated by the details of the transaction data. Theoretical (but still ESRS compliant) estimates are used for those suppliers who does not give Automated ESRS access to their financial transactions, or who are outside the EU toll boundary.

Automated ESRS can follow the value chain all the way from top to bottom (and through the loops, such as from farm over supermarket and back to the farmer’s table – without counting any emission or energy use more than once) and obtain data from suppliers, sub-suppliers, etc. In this way, a very precise figure can be made for Scope 3. This requires that the suppliers give Automated ESRS access to calculate on their financial transactions.

If some suppliers do not grant access to their transactions, Automated ESRS uses a classic (but still compliant) calculation based on LCA models (life cycle models) and procurement categories.

It is far more accurate to use financial transactions (activity based) as in Automated ESRS, than LCA models and models based on expenses (spend-cases).

This is due to several factors:

With the introduction of ESRS, the requirements for CO2 calculations become more concrete, detailed, and restrictive. The company must be able to document significant impacts for the entire value chain in detail.

Automated ESRS gives the company's value chain (Scope 3) the opportunity for ESRS-compliant calculations and insights for all value chain links (tier-1 to tier-n) - and thus the opportunity to effectively comply with the ESRS legislation as well as prioritize, engage, and drive emission reductions to achieve the company's goals.

It's vital for us to set our solution (automated ESRS) apart from AI-driven ESG/ESRS solutions – Automated ESRS is a Context-based solution. Our unique approach is designed on the principles of Decision Intelligence, centered on context within and around data.

We do NOT use OpenAI to directly interpret or calculate on customer data, nor do we use it for finding sources or similar critical tasks – these are all handled solely by our proprietary Genetix Decision Intelligence (GDI).

We only apply the use of large language models (LLMs), primarily OpenAI’s GPT-4 (1), to the financial transaction data to translate between different languages and formulate documentation in a less technical manner.

OpenAI, now heavily invested in by Microsoft (2), is never given access to customer data, only abstracted and scrambled general examples or word bits for translation.

In terms of generating reports, GPT-4 can transform raw data into human-readable summaries or detailed reports, helping stakeholders understand the company's ESRS performance.

Our GDI (Genetix Decision Intelligence) technology harnesses the power of human-like cognitive thinking, infusing situational context into data. This addresses the limitations commonly found in current algorithmic techniques, which often face the challenge of their models becoming static leading to incorrect or insufficient results, and current AI which has a problem with ‘hallucination’ – basically inventing ‘facts’ based on incorrect understanding of the context (3).

In contrast, Automated ESRS empowers our model with context-based data and examples, ensuring more reliable and consistent outcomes - combined with full transparency and audit trail.

Our Decision Intelligence technology provides a distinct advantage - as it continually performs self-testing loops and raises questions about unusual data inputs or unexpected data behavior/results. This insistence on understanding context makes the automated ESRS solution highly efficient and human-like in its reasoning abilities. This does not mean it never makes mistakes, but that it is aware of them and honest about its doubts. Our language model is continually guided along a streamlined problem-solving path, allowing it to systematically explore multiple outcomes in an organized manner.

Through our commitment to decision intelligence, we've addressed this problem, providing not only valuable insights and outcomes but also transparency and context. Enabling our solution to provide activity-based calculations guaranteeing more accurate, faster, resource-efficient and reliable results in a challenging ESRS compliance environment.

2) Microsoft and OpenAI extend partnership - The Official Microsoft Blog

3) Are AI models doomed to always hallucinate? | TechCrunch

Across the team we cover more than four decades of business and compliance experience, as well as more than a decade working with CSRD/ESRS and its precursors - enabling organizations to leverage technology, making compliance and business value go hand in hand.

The Genetix Decision Intelligence (GDI) software engine that makes ESRS.tools possible, was developed by Genetix Computing ApS in close collaboration with IBM, Danish University of Technology and University of Augsburg, and has since 2012 helped several major organisations realize savings and organizational improvements, from Danish State Railways (DSB) to Energinet.

GDI is developed to collect, analyze and calculate data intelligently, understanding the context it works within - not unlike a human, but without the black box of machine learning – while finding connections, bottlenecks, optimizations and extra value in extremely complex data structures.

If interested in the most recent whitepaper on Genetix Decision Intelligence, please contact Claus.

Copyright © Genetix Computing ApS